-

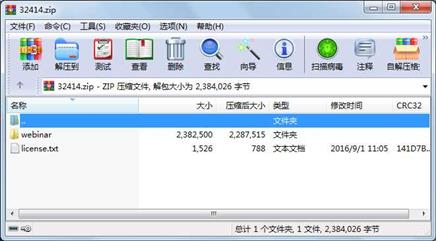

大小: 2.18MB文件类型: .zip金币: 2下载: 0 次发布日期: 2023-09-07

- 语言: Matlab

- 标签: MATLAN 三因子 fama-French

资源简介

该文件是基于fama-French三因子模型而编写的MATLAB程序代码。里面有详细说明和PDF文档

代码片段和文件信息

%FFestimateCAPM Estimate rolling parameters for CAPM 1-factor model.

clear all

% Step 1 - load in raw data and set up list of Fama & French factors

load FFUniverseCAPM

% Step 2 - convert total return prices to total returns

Returns = (CAPMUniverse - lagts(CAPMUniverse1)) ./ lagts(CAPMUniverse1);

% Step 3 - trim date range to match date range of factor returns

Returns = Returns(all(isfinite(fts2mat(extfield(Returns CAPMFactorList)))2));

% Step 4 - get information about data

SeriesList = fieldnames(Returns 1);

AssetList = setdiff(SeriesList CAPMFactorList);

NumSeries = numel(SeriesList);

NumAssets = numel(AssetList);

% Step 5 - primary controls

TMonth = 9; % terminal month for each historical estimation period

Window = 5; % historical estimation period in years

MaxNaNs = 4*260; % max number of daily NaNs in an estimation period

% Step 6 - set up date math

StartYear = year(Returns.dates(1));

StartMonth = month(Returns.dates(1));

EndYear = year(Returns.dates(end));

EndMonth = month(Returns.dates(end));

if StartMonth > TMonth

StartYear = StartYear + 1;

end

if EndMonth < TMonth

EndYear = EndYear - 1;

end

if (EndYear - StartYear) < Window

error(‘Insufficient data to perform analysis.‘);

end

NumPeriods = EndYear - StartYear - Window + 1;

% Step 7 - final setup

AnalysisPeriod = NaN(NumPeriods1);

CAPMAlpha = NaN(NumAssets NumPeriods);

CAPMBeta = NaN(NumAssets NumPeriods);

CAPMSigma = NaN(NumAssets NumPeriods);

CAPMStdAlpha = NaN(NumAssets NumPeriods);

CAPMStdBeta = NaN(NumAssets NumPeriods);

CAPMLLF = NaN(NumPeriods1);

CAPMDoF = NaN(NumPeriods1);

% Step 8 - main loop

TYear = StartYear + Window; % initial terminal year

for K = 1:NumPeriods

% Step 8a - get start and end dates for current analysis period

StartDate = datenum(TYear - WindowTMontheomday(TYearTMonth)) + 1;

EndDate = datenum(TYearTMontheomday(TYearTMonth));

%fprintf(1‘Period %2d: Target Range [%s - %s]\n‘Kdatestr(StartDate1)datestr(EndDate1));

% Step 8b - locate actual start and end dates in the data

StartIndex = find(Returns.dates >= StartDate1‘first‘);

EndIndex = find(Returns.dates <= EndDate1‘last‘);

AnalysisPeriod(K) = Returns.dates(EndIndex);

% Step 8c - determine active assets for current analysis period

Active = true(NumAssets1);

for i = 1:NumAssets

TestActive = sum(~isfinite(fts2mat(Returns.(AssetList{i})(StartIndex:EndIndex))));

if TestActive > MaxNaNs;

Active(i) = false;

end

end

NumActive = sum(Active);

fprintf(1‘ Points %5d:%5d: Dates = [%s : %s] Active Assets = %d\n‘ ...

StartIndexEndIndexdatestr(Returns.dates(StartIndex)1) ...

datestr(Returns.dates(EndIndex)1)NumActive);

% Step 8d - set up regression with active assets over current date range

Dates = Returns.dates(StartIndex:EndIndex);

AssetData = fts2mat(Returns.(AssetList));

AssetData = AssetData(StartIndex属性 大小 日期 时间 名称

----------- --------- ---------- ----- ----

文件 751758 2016-09-01 11:05 webinar\FFUniverse.mat

文件 4491 2016-09-01 11:05 webinar\FFestimateCAPM.m

文件 5253 2016-09-01 11:05 webinar\FFestimateFF.m

文件 1602548 2016-09-01 11:05 webinar\Using ML to Develop Asset Pricing-111606.pdf

文件 2424 2016-09-01 11:05 webinar\readme.txt

文件 15699 2016-09-01 11:05 webinar\FFwebinar.m

文件 327 2016-09-01 11:05 webinar\erratum.txt

文件 1526 2016-09-01 11:05 license.txt

- 上一篇:基于Meanshift的单目标跟踪

- 下一篇:火车时刻表数据库2008年

川公网安备 51152502000135号

川公网安备 51152502000135号

评论

共有 条评论