资源简介

matlab开发-kmvcreditriskmodel违约风险概率。根据穆迪的KMV计算违约概率。公司股票遵循欧洲认购期权

代码片段和文件信息

function [N1TVSG]=KMV_MODEL(SEQFrTENDN)

%% Document title

% KMV-Merton model Probability of Default represented by Jin-Chuan Duan Genevi‘eve Gauthier and

% Jean-Guy Simonato (2005)

% This code calculates the probability of default based on Moody抯 KMV

% where firms equity follows European call option.

%% Author

% Author : Haidar Haidar University of Sussex Email: h.haidar@sussex.ac.uk

% Date: 3rd - April - 2010 homepage: http://www.maths.sussex.ac.uk/~hh56

%% Reference:

% 1) On the Equivalence of the KMV and Maximum Likelihood Methods for

% Structural Credit Risk Models by Jin-Chuan Duan Genevi‘eve Gauthier and

% Jean-Guy Simonato 2005

%% Inputs

% S : Vector of Share prices as a time series starts with times t=123.

% EQ : Number of outstanding shares

% F : Total Liabilities

% r : free interest rate

% TEND : Time horizontal in years

% N : Number of time steps

%% Accuracy

% NR_Acc : The accuracy of Newton Raphson method

% Sig_Acc : The accuracy of Sigma

%% Example

% [N1TSG]=KMV_MODEL(cumprod(((rand(1100)-0.55)/10)+1)10.90.05550)

%% OutPut

%

% N1 : The Expected Probability of Default

% TV : Time Horizontal for the correspoding probability of default

% SG : Asset Volatility

%% Code

%%%%%%%%%%%%

Sig_Acc=10^-7;

lm=length(S);

E=S*EQ;

% Scale the values

if E>1000

E=E/10000;

F=F/10000;

end

LS=log(S(2:end)./S(1:end-1));

h=length(E);

SGE=std(LS);

% SG : Asset Volatility to be computed here is given an initial value.

SG=SGE*(E(1)/(E(1)+F));

TV=TEND/N:TEND/N:TEND;

for jkk=1:N

% i=1;

% TM is the Asset Volatility at the previous iteration

% TM is initialized at the first step

TM=100;

while abs(SG-TM)>Sig_Acc

for j=1:lm

% V(j) is the asset value at time step j

V(j)=NRMethod(FFE(j)rTV(jkk)SG);

end

% LR is the implied asset returns ( Log returns )

LR=log(V(2:end)./V(1:end-1));

R=mean(LR);

TM=SG;

SG=std(LR)*sqrt(h);

% Mu is the expected return of the asset value

Mu =h*R+0.5*SG^2;

% i=i+1;

end

% SG % asset volatility

d1=-(log(V(lm)/F(1))+(Mu -(0.5*SG^2))*TV(jkk))/(SG*sqrt(TV(jkk)));

N1(jkk)=0.5*(1+erf(d1/sqrt(2)));

end

plot(TVN1‘b‘)

xlabel(‘Time Horizontal in Years‘)

ylabel(‘Expected Probability of Default‘)

return

% Date: 3rd - April - 2010

% Author : Haidar Haidar

% University of Sussex

% Email: h.haidar@sussex.ac.uk

% Newton Raphson method

function [S]=NRMethod(SEcrTsig)

NR_Acc=10^-7;

Tem=0;

k=1;

while abs(S-Tem)>NR_Acc

d1=(log(S/E)+(r+(0.5*sig^2))*T)/(sig*sqrt(T));

d2=d1-(sig*sqrt(T));

f=c-S*0.5.*(1+erf(d1/sqrt(2)))+exp(-r*(T))*E*0.5*(1+erf(d2/sqrt(2)));

df=-0.5.*(1+erf(d1/sqrt(2))); % the derivative

Tem=S;

S=Tem-f/df;

k=k+1;

end

return

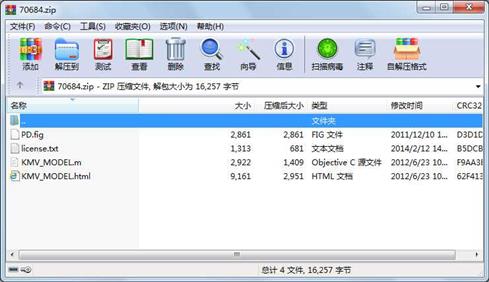

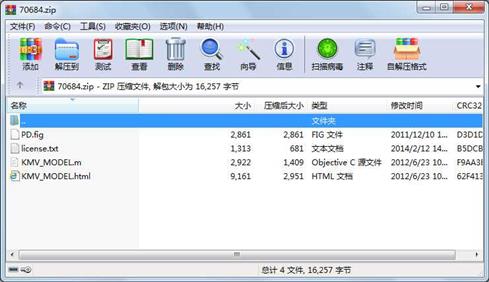

属性 大小 日期 时间 名称

----------- --------- ---------- ----- ----

文件 9161 2012-06-23 02:09 KMV_MODEL.html

文件 2922 2012-06-23 02:09 KMV_MODEL.m

文件 2861 2011-12-10 04:45 PD.fig

文件 1313 2014-02-12 14:03 license.txt

相关资源

- matlab开发-能带计算

- matlab开发-FlockingAlgorithm

- matlab开发-MuellerStokesJonesCalculus

- matlab开发-HX711的自定义数据库

- matlab开发-SMOTEBoost

- matlab开发-果蝇优化算法第二版

- matlab开发-多变量决策树

- matlab开发-水轮发电机模型

- matlab开发-交通警告标志识别标签代码

- matlab开发-RUSBoost

- matlab开发-基于遗传算法的机器人运动

- matlab开发-MPU6050加速度陀螺仪

- matlab开发-功率曲线FAsmallscalewindturbi

- matlab开发-NASAJPLDE405开发星历表

- matlab开发-SortinoRatio

- matlab开发-永磁TDC并联电机数学模型

- matlab开发-3相SPWM整流器

- matlab开发-Kilobotswarm控制Matlabarduino

- matlab开发-简单音频播放

- matlab开发-记录文件的绘图仪加速度、

- matlab开发-永磁同步电机PMSM动态数学模

- matlab开发-多目标优化差分进化算法

- matlab开发-随机微分方程解算

- matlab开发-波长调制光谱的二次谐波模

- matlab开发-仿制药生物生理学基础药动

- matlab开发-使用svmrfe选择功能

- matlab开发-KDTreeNearestNeighborandRangeSear

- matlab开发-stlread

- matlab开发-三维图像堆栈查看器

- matlab开发-动态电压恢复器故障dvr

川公网安备 51152502000135号

川公网安备 51152502000135号

评论

共有 条评论